The value added tax or the VAT in North Macedonia applies to most of the products and services provided in this country, in compliance with the EU directives and the applicable legislation. Macedonia imposes two types of VAT, depending on the goods and their categories. If you would like to set up a company in Macedonia and find out information about the taxation structure in this country, please feel free to get in touch with our team of company formation agents in Macedonia.

| Quick Facts | |

|---|---|

| We offer VAT registration services in Macedonia | Yes |

|

Standard rate |

18% |

|

Lower rates |

– 10% for restaurant and catering services, – 5% for newspapers, food supply, agricultural material, medical equipment |

| Who needs to register for VAT in Macedonia? |

Companies with annual turnover exceeding MKD 2 million |

| Time frame for VAT registration in Macedonia |

Around 10 days |

| VAT for real estate transactions |

18% |

| Exemptions available |

No VAT for: – residential property lease, – supply of banking and financial services, – lottery, – services provided by professional entities |

| Period for filing |

By the 25th of the following month |

| VAT returns support |

Yes |

| VAT refund | Under specific agreements with countries that offer VAT refund |

| Local tax agent required |

YES, for foreign companies |

| Who collects the VAT |

The Public Revenue Office in Macedonia |

| Documents for VAT registration in Macedonia |

– Articles of Association, – Certificate of Incorporation, – other standard forms |

| VAT number format |

13 digits |

| VAT de-registration situations | In case the company closes its activities in Macedonia |

| Deductible VAT |

For: – equipment, – consultancy, – telecommunication, – advertising, etc. |

|

Deadlines for VAT payments |

Within 30 days after the end of each tax period |

|

VAT groups (YES/NO) |

YES |

| VAT registration for sole traders |

Subject to the same VAT rules as any other legal entity |

| VAT registration for branches (YES/NO) |

YES |

| VAT registration for liaison offices (YES/NO) |

NO |

| VAT registration for foreign digital services |

Mandatory upon offering first taxable supplies/services |

| Record-keeping requirements |

5 years |

| Invoice content |

– invoice number, – date of issue, – name and address of supplier and customer, – registration number of the supplier, – VAT rate and VAT base, – quantity and description of goods/services. |

| Voluntary VAT registration (YES/NO) | YES |

| Power of attorney |

Our company incorporation agents can help with VAT registration through a power of attorney. |

| Penalties for late VAT registration |

Depends on the size of the legal entity |

| Reverse charge mechanism |

Usually used for cross-border transactions to prevent double taxation issues |

| Simplified invoices |

Not applicable in Macedonia |

| Additional services provided by our team |

Our team can also help interested individuals open a company in Macedonia. |

What are the VAT rates in Macedonia in 2024?

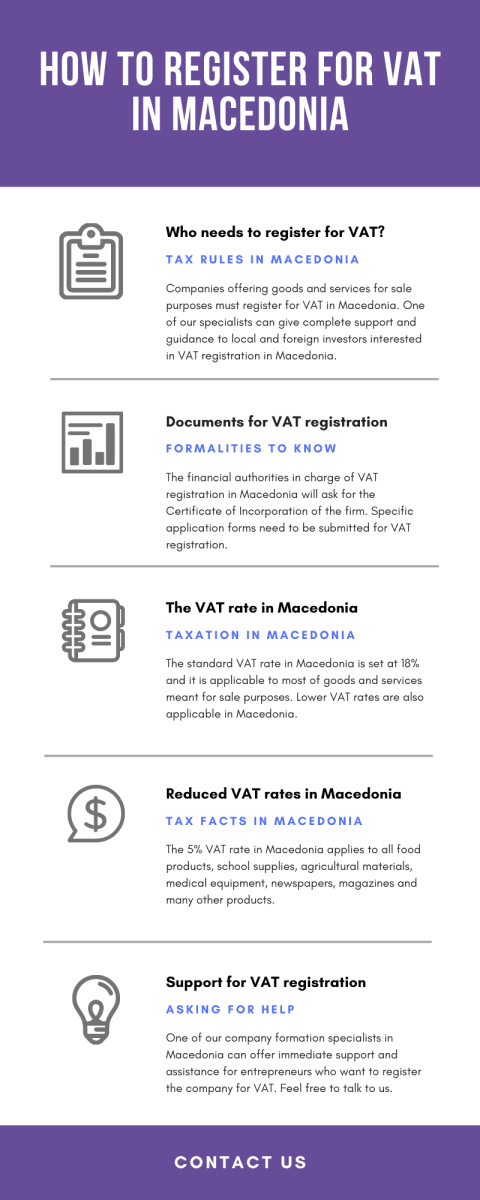

The standard VAT rate in Macedonia in 2024 is set at 18% for products and services available for sale purposes in this country. A VAT rate of 5% is applicable to the following categories:

- water supply in Macedonia;

- agricultural materials, wood pellets, equipment, and pellet boilers;

- school supplies like books, pencils, pens, notebooks, and backpacks;

- newspapers, magazines, books, publications without the ones meant for advertising purposes;

- medical equipment, accommodation services (hotels and resorts), and public transportation.

The recent VAT legislation modifications mention that basic foodstuff is exempt from this kind of tax. This means that there is 0% for bread, sugar, sunflower oil, eggs, and flour, among other products.

We remind that the above-mentioned products and services are subject to a special VAT which is set at a 5% rate. If you are interested in establishing a company in North Macedonia in 2024 and you are looking for support in this direction, feel free to talk to us as soon as possible.

The VAT rate for electricity increased to 10% in 2024 and remains the same until July when it will be established at 18%. However, the VAT for certain fuels has been reduced from 18% to 10% rate.

How can I register for VAT purposes?

Since January 2020, companies carrying out operations of a total turnover of MKD 2 million in Macedonia need to register for VAT purposes. It is good to know that if the business had financial activities for only a specific period of time in a year, only that period will be subject to VAT in Macedonia. The VAT registration starts at the PRO Regional Office which provides the requirements in this sense, regarding the documents and the applications which need to be submitted.

The company’s documents and the Certificate of Incorporation of the firm must be submitted to the entitled authorities when registering for VAT in Macedonia. Form DDV-01 is also needed for VAT registration in Macedonia. There are no complicated formalities, however, you can take care of your business and let us deal with the bureaucracies in terms of VAT registration in this country.If you need assistance in this matter, please do not hesitate to ask us for information.

The 10% VAT rate is applicable to catering services and the supply of food and specific beverages for immediate consumption. More about VAT and applicable legislation can be discussed with one of our local agents.

Support for micro and small companies in Macedonia

Starting with January 2020, the VAT threshold has been modified, and the rule remains available for 2024 also. This means that the registration for VAT can be made by companies exceeding the MKD 2 million threshold, as mentioned by the new VAT tax scheme. This is one of the methods and measures through which the Macedonian government and particularly the Ministry of Finance, wants to attract even more entrepreneurs in the country.

The tax administration in Macedonia continues to simplify and optimize the tax collection methods and also the tax returns, in order to provide a proper and enhanced business environment for small and medium entrepreneurs in the country. All the new rules related to VAT in Macedonia can be explained by one of our company formation representatives who can also provide support for company incorporation in North Macedonia.

Other tax facts in Macedonia

Besides the VAT imposed on most goods and services offered for sale in Macedonia, companies and entrepreneurs must also observe other taxes too. For example, import companies are subject to the customs duties of up to 31% for importing agricultural products in Macedonia. Industrial products for import purposes in Macedonia are subject to customs duties of no more than a 23% rate. We remind that Macedonia is part of the Stabilization and Association Agreement signed with the EU, and also part of the Central European Free Trade Agreement, and the European Free Trade Association.

The excise duties are imposed on specific goods imported in Macedonia, like tobacco products, alcoholic beverages, electricity fuels, and many more. The property tax and the transfer tax, and the communal taxes are other important taxes to consider in Macedonia. On the other hand, there are also tax exemptions in Macedonia, for example, no stamp taxes payable in this country.

Social contributions in Macedonia

Employers in Macedonia, whether local or from abroad must pay attention to the social contributions imposed on gross salary. The health insurance of a 7.4% rate, the pension and disability insurance of 18.4% rate, and the employment insurance rate of 1.2% are among the social contributions payable in Macedonia. If you are interested in starting a business in Macedonia, it is important to pay attention to the taxation regime imposed in this country. One of our consultants can provide complete support in this matter and can help foreigners open a company in Macedonia in 2024.

Deadline for VAT submission in Macedonia

All companies and taxpayers must verify the accounts and the financial records until the 15th of January of each year when they have to submit the VAT applications for their turnovers. We remind that this rule is available only for enterprises with profits of at least MKD 2 million, as established for this year.

Who doesn’t need to pay VAT in Macedonia?

The VAT is not imposed for taxpayers with annual turnovers not exceeding MKD 2 million, as established for this year. Also, from the obligation for VAT registration, taxpayers who are not residents in Macedonia are excluded if they carry out a taxable turnover for which the tax debt is assigned to the fulfilling beneficiary. Also, non-residents in Macedonia subject to returning of previous tax in a special procedure are exempt from VAT. Feel free to address our team of company formation agents in Macedonia and find out more about the VAT registration in Macedonia.

Making investments in Macedonia

Macedonia provides a proper business climate to all international investors looking to thrive in this part of Europe. The excellent economic relations with countries worldwide are also supported by the numerous agreements and conventions signed by Macedonia, among which, the double taxation treaties. Macedonia is quite appealing from a taxation point of view, one of the important benefits offered to foreign investors, alongside a skilled workforce and numerous developed business sectors like agriculture, tourism, manufacturing, etc. The following facts and numbers can highlight in a large percent of the business and the economy direction of Macedonia:

- Around 47% of the total FDI stock for 2018 supported the GDP in Macedonia;

- Austria and Germany are the main investors in Macedonia;

- Most of the FDIs in Macedonia are directed to the services sector;

- The FDI inward flow for 2019 in Macedonia was around USD 365 million.

- Around USD 7.24 billion represented the total FDI stock for 2021 in Macedonia;

We invite you to contact our team of company incorporation specialists in Macedonia for additional information about the VAT registration in Macedonia and the formalities implicated for 2024.