Our team specializing in company formation in Macedonia offers complete business registration services, as well as ongoing assistance for several important post-registration steps for all types of companies. Foreign and local entrepreneurs can easily set up limited liability companies, limited or general partnerships, or joint stock companies. Because the processes needed to open a company in Macedonia need complete attention, especially if you are a foreigner, it is suggested to talk to one of our specialists in company formation in North Macedonia for information and assistance.

| Quick Facts | |

|---|---|

| Types of companies |

Limited liability company Joint stock company Limited partnership General partnership Sole proprietorship |

|

Minimum share capital for LTD Company |

EUR 5,000 |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation (approx.) |

2 weeks |

| Corporate tax rate |

10% |

| Dividend tax rate |

10% |

| VAT rate |

18%, reduced rates of 10% and 5% also apply to certain goods |

| Number of double taxation treaties (approx.) | 48 |

| Do you supply a registered address? | Yes |

| Local director required | No |

| Annual meeting required | Yes |

| Shelf company available | Yes |

| Electronic signature | Yes |

| Is accounting/annual return required? | Yes |

| Foreign-ownership allowed | Yes |

| Any tax exemptions available? | Corporate income tax exemption for companies with annual income of up to MKD 3 million |

| Tax incentives | 10 year tax holiday in certain conditions |

Types of companies you can open in North Macedonia

Nationals and foreigners can choose between several business forms once they decide to open a company in Macedonia. The following entities are available for incorporation:

- limited liability companies;

- joint stock companies;

- limited partnerships;

- general partnerships;

- sole proprietorships.

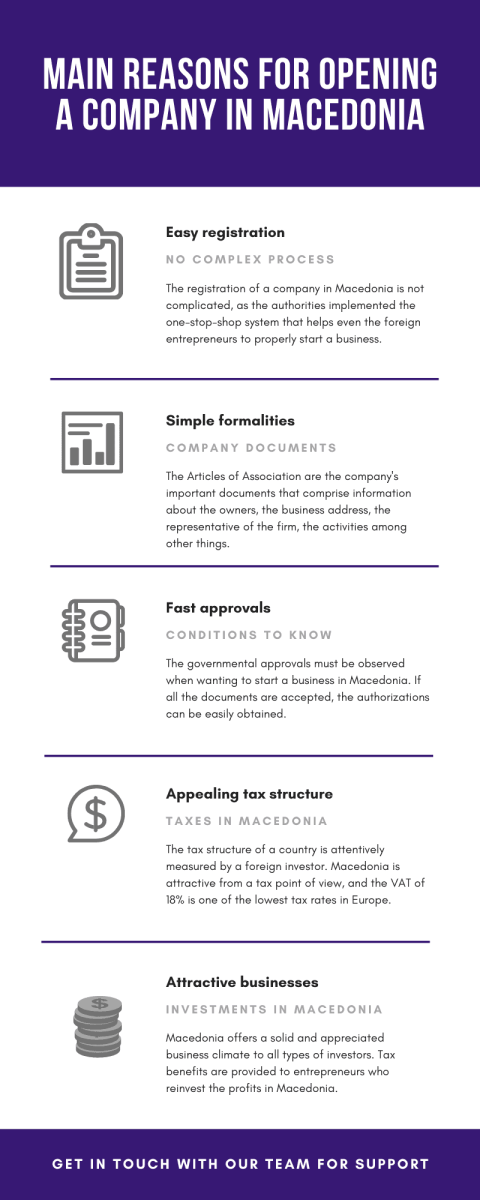

Just like in most European states, the limited liability company is the preferred business structure for all kinds of activities and it is a common choice for those who are interested in company formation in Macedonia. The easy incorporation process allows investors to set up their operations in a fast and reliable manner. One should bear in mind that the minimum share capital for this entity is set at EUR 5,000 and can be deposited in a Macedonian bank account. A limited liability company in Macedonia can be established by at least one stockholder and a maximum of 50 members. Because the market is welcoming and the business field anticipates the needs of foreign investors, one can buy shelf companies or ready-made companies which can be used as soon as the ownership has been granted and accepted by the Central Registry of the Republic of Macedonia.

Our agents specializing in company incorporation in Macedonia can provide you with support in company registration and additional details about the services we can offer in this direction. Also, if you do not want to have a traditional office, you may ask for virtual office services in Macedonia for which our team can offer complete information. The Macedonian market is diverse and accepts foreign branches or subsidiaries to join the business field. Also, if you want to adopt a simple form of business at the beginning, you can establish your operations as a sole proprietor in Macedonia.

What other entities can be registered in Macedonia?

A form of business designed for large businesses is the Macedonian Joint Stock Company (AD) where the liability of its members is limited like in the case of the DOO but the requested minimum share capital is higher: EUR 25,000. Unlike in a limited liability company, the shares of this type of business can be registered on the Stock Exchange. This is a common choice for company incorporation in Macedonia for large foreign companies.

Two or more partners can be united under the same agreement and form a General Partnership (JTD) in Macedonia sharing the same responsibility and having the same managerial powers. In this type of business, no minimum share capital must be delivered at the moment of registration. In case of liquidation, the personal assets of the owners are not protected and can be used in order to cover the liabilities.

Another form of partnership is the Limited Partnership (KD) in Macedonia which is formed by at least one general partner with unlimited liability on the profits and debts and the one limited with liability limited by their contribution to the capital. All the major decisions are taken by the general partner, but if this member cannot be a part of the legal entity, the business is dissolved. A form of partnership in Macedonia where the capital is divided into shares is the Limited Partnership with Shares (KDADA) formed by at least three shareholders, general partners, and silent partners.

How can I set up an LLC in Macedonia?

For many of those who wish to set up a company in Macedonia, the LLC is the business form of choice. Foreigners who want to set up limited liability companies or D.O.O. (Drushtvo so Ogranichena Odgovornost) need to provide the necessary information to the Trade Register and the local offices in Macedonia. EUR 5,000 or approximately MKD 308,000 represents the minimum share capital that needs to be prepared for LLC incorporation. As soon as the Articles of Association have been accepted by the Central Registry of the Republic of Macedonia, the owners need to apply for the company’s seal, tax purposes, social contributions, and other related matters. Our team of advisors is at your disposal with assistance in opening a D.O.O. in Macedonia.

We invite you to watch the video below:

Can I open a branch in Macedonia?

In some cases, the chosen route for company incorporation in Macedonia for a foreign legal entity will be to open a branch.

Foreign companies can set up branches in North Macedonia if the following documents are prepared and accepted by the commercial division in the chosen city:

- the registration certificate of the foreign company interested in establishing a branch;

- the agreement showing that the parent company wants to enter Macedonia through a branch;

- documents with comprehensive information about the future activities of the branch in Macedonia;

- information about the representative agent with residency in Macedonia who will act on behalf of the branch.

Foreign companies setting up a branch in Northern Macedonia will be effectively expanding their business operations, however, the branch will be engaged in the same types of activities as the parent company abroad. The foreign company is liable for the debts incurred by its Macedonian branch.

In terms of taxation, the branch will be subject to the corporate income tax rate applicable to all companies in the country (you can read more about corporate taxation below, as presented by our team specializing in company formation in Mcedonia).

Can I open a subsidiary in Macedonia?

Yes, a subsidiary can be opened by companies from abroad who are interested in this type of independent legal entity. This is normally operating under the limited liability company which can be set up for a minimum share capital of EUR 5,000.

Main issues concerning company incorporation in Macedonia

The one-stop shop assured by the Central Registry of the Republic of Macedonia is the single institution for registering all economic entities. From the moment the founders deliver the notarized documents, the entity is registered to the Trade Register (in order to receive the statistic number).

The process of company incorporation in Macedonia starts with drafting and notarizing the articles of association (or the agreement for establishing a company) and the signature specimen of the manager. The process requires only one day for completion

The other steps for company formation in Macedonia are registering the company with the Public Revenue Office, publishing the LLC formation notice on the Central Register’s website, and opening the company bank account.

The registration for the Employment Agency is also made through the Central Registry. The Agency will allow the registration of the first directors and the registration of the employees with the social funds. Please bear in mind that the Articles of Association are significant documents necessary for company registration and need to comprise the following matters:

- The structure of the business, the name, and the domiciliation of the owners;

- The name of your company in Macedonia and the official business address;

- Information about the minimum share capital provided to a Macedonian bank account;

- Details about the board of managers, the type of activities and about the company secretary.

Steps for company formation in North Macedonia

A limited liability in Macedonia can be easily registered by local and foreign nationals alike. However, the latter might wish to request the services of a team specializing in the steps needed to open a company in Macedonia, such as our team. The following stages or steps are relevant:

- Appoint a representative for your company, with residency in Macedonia.

- Prepare the Articles of Association and the Memorandum of Association with complete details about the owners, the business address, the company’s activities, etc.

- Fill out the forms imposed by the Central Registry of the Republic of Macedonia.

- Open a bank account for depositing the minimum share capital and for future financial operations.

- Apply for licenses and permits to start your operations in Macedonia properly.

- Register for tax purposes and apply for the company’s seal as soon as you receive the Certificate of Incorporation.

North Macedonia keeps a Beneficial Ownership Registry as part of its Central Registry. This is done to ensure the transparency of the ownership structure for the registered companies. Therefore, the beneficial owner of the company will submit certain personal data, as well as information on the commencement of the said beneficial ownership. The information in the Registry is public.

The Registry of Direct Investment concerns foreign investments, as well as the participation of non-residents in domestic entities. Foreign investments, such as when a foreign national will set up a company in Macedonia, are entered into this registry.

What are virtual office services in Macedonia?

The virtual office services are a set of facilities dedicated to entrepreneurs who want to avoid opening a traditional office in Macedonia. These services are subject to low costs and foreigners can benefit from special facilities like a notable business address, mail collecting and forwarding, a local phone number, and a private one, plus a voice mailbox on request. Also, the collection of bank statements can be provided on request.

For some investors who open a company in Macedonia, such as those who are able to engage in remote work, this can be a suitable option. You can ask our advisors for extra information about the virtual office services in Macedonia.

Shelf companies in Macedonia

Ready-made companies or shelf companies are meant to serve the business requirements of foreign investors interested in fast implementation of their activities on the Macedonian market. This is an option for those who wish to enjoy the advantages of company incorporation in Macedonia without having to go through all the registration steps.

A shelf company in Macedonia is already registered to the Central Registry of the Republic of Macedonia and it is prepared to be used as soon as the ownership transfer is completed. It is good to know that a ready-made company in Macedonia is kept on a shelf until it ages, it has no financial activities, and therefore no liabilities. Foreign investors wanting a fast start with their businesses can decide on purchasing a ready-made company without having to wait for the procedures to set up a company in Macedonia.

What is a liaison office in Macedonia?

Some companies may decide to set up a liaison office before they open a company in Macedonia. The liaison office is suitable for those companies interested in first performing market research in different industries. Just like a shelf company, a liaison office is not subject to financial operations and therefore, no debts.

Among the attributes of a liaison office in Macedonia, it is good to know that it cannot sign contracts, have financial activities, or issue invoices. A liaison office makes the connection between the country in which an entrepreneur wants to open a company and the foreign enterprise. Such an office needs a representative who will regularly connect with the company from abroad and its shareholders interested in setting up their business presence in Macedonia. For more information about a liaison office in Macedonia, feel free to talk to us.

We can provide accounting services for your company in Macedonia

All companies need accounting services and complete control of the financial activities involved. An accounting firm in Macedonia can be the proper solution for your business, and there are numerous companies that have externalized accounting services instead of a department dealing with such operations. Among the accounting services we can provide for your firm, we mention payroll services, bookkeeping, support for VAT registration, tax consulting, and tax minimization methods if you are interested in cutting the expenses in the company.

We can also handle the submission of the annual financial statements for your company in Macedonia, with respect to the International Financial Reporting Standards. Feel free to contact our consultants for in-depth information and support after you open a company in Macedonia.

Central Registry of the Republic of Macedonia

Instead of submitting the documents to all kinds of institutions, Macedonia offers the possibility of carrying out the registration procedure when you set up a company in Macedonia with a single institution. At the moment, foreigners can set up their businesses with the following register offices:

- Register for Real Estate Investment;

- Register of Direct Investment;

- Register of Property;

- Register of Annual Accounts.

These registers help foreign entrepreneurs in the registration process and with updated information regarding the steps involved. Moreover, the Central Registry of the Republic of Macedonia has its database linked with the European Business Registers for proper communication and complete access to any desired information about the types of businesses any investor wants to settle. When deciding on a suitable business form in Macedonia, the recommendation is to ask for support and guidelines from our Macedonian company incorporation agents, in order to get a fast start on the market for your activities.

Information verification with the Central Registry of the Republic of Macedonia

The procedure of searching through database requires the creation of a new account on the website. The information can be searched using the company name or other relevant keywords. Also, an extract can be obtained by visiting in person one of the Central Registry offices.

Do foreign investors need to be in Macedonia for company registration?

No, foreign entrepreneurs do not need to travel to Macedonia for a company formation at the Central Registry of the Republic of Macedonia. You may get in touch with our consultants who can act on behalf of your future company, with a power of attorney.

Company taxation in Macedonia

An important issue to consider by investors when they choose to open a limited liability company or joint-stock company in Macedonia is related to the taxation of these business entities.

As part of our services related to company formation in Macedonia, we also advise our clients on the tax implications for their chosen business structures. Thus, we highlight the fact that a public company may be subject to different, more complex requirements for annual reporting and auditing, as well as compliance with other bodies in the country, such as financial regulators for large companies that offer banking or financial services.

The following taxes are relevant for investors who wish to open a company in North Macedonia:

- 10% corporate income tax; the same corporate income tax rate also applies to branches;

- 10% withholding tax on dividend payments made to a non-resident company, unless reduced through a double tax treaty;

- 18% standard value-added tax, with two reduced taxes of 10% and 5%, as well as a 0% rate for certain types of goods and services;

- 7.5% of the salary in social security contributions made by the employer for health insurance purposes (to which 0.5% additional contributions can apply), as well as 18.8% payable by the employer for the pension and disability fund.

VAT registration in Macedonia takes place for those companies that have a turnover of more than MKD 2 million (or approximately EUR 32,464) per year.

The following general rules apply in terms of the filing and payment of different taxes:

- VAT returns are submitted on the 25th day of the month following the one for which the tax period refers to (monthly or quarterly, according to the company’s turnover);

- VAT payments are made within 30 days after the end of the tax period (as calculated according to the turnover);

- Companies file a tax return at the end of February or by 15th of March the year following the one for which the submission is made;

- Monthly advance tax payments are usually made based on the tax payments made for the previous year;

- Companies file separate returns, as consolidated returns are not permitted.

A resident company in North Macedonia (that is, a company registered in the country) is subject to corporate income tax on its worldwide income. A permanent establishment of a foreign company (such as a branch, which derives income from North Macedonia) is only subject to tax on the profits it derives from the country.

There is no surtax for companies and no alternative minimum tax, given the fact that the corporate income tax rate is already a small one, when compared to other countries, such as some countries in Europe, for example.

Branches in North Macedonia are taxed in the same way as subsidiaries.

Company liquidation in Macedonia

For varied reasons, companies may face difficulties and financial problems for which restructuring is not a good option. The next step in this sense is liquidating the company or in other words, closing the activities. This may take place only after the General Meeting decides to do so and if:

- The bankruptcy process begins;

- If the business does not respect the law, particularly the Company Act in Macedonia.

In cases of general and limited partnerships registered in Macedonia, if a bankruptcy process started against one of the partners, the other member is authorized to obtain the general partnership and all of its liabilities and assets without a termination procedure in this sense. Please keep in mind that the records and the forms created at the time of company liquidation must be submitted to the Central Registry of the Republic of Macedonia.

Macedonia economic overview

Situated in the center of the Balkans, Macedonia, even though it’s a small country, it is considered one of the most desired destinations when it comes to starting a company. With a great fiscal policy and well-developed infrastructure, it is one of the most wanted locations for investors. These measures were taken recently in order to encourage Macedonian and foreign investors. Also, a number of treaties were signed to establish a good fiscal environment-like the double taxation treaties (with more than 30 countries). Macedonia is considered one of the most liberalized countries when it comes to telecommunications. The internet is highly developed, Macedonia being a leader in Wi-Fi technology, another considerable advantage for those businessmen who want to open companies in Macedonia.

Macedonia is represented by its major cities like Skopje (the capital), Tetovo, Ohrida, Prilep, Bitola, Veles, Gostivar, Strumica, Kumanovo or Crusova. As for the industries developed in Macedonia, we mention that the country has a solid economy based on agriculture, a large production of textiles, and a consistent trading sector with significant partners like Greece, Italy, Spain, Germany, Russia and Serbia among many others. The USA is also a reliable trading partner for Macedonia considering the fruitful collaboration for 2017, the year in which about $ 300 million were registered from imports and exports.

If you want to benefit from the company formation services our agents in Macedonia can offer, please do not hesitate to contact us right away.

Frequently asked questions

Any foreign investor over 18 years of age and who provides the minimum share capital as stipulated by the Companies Act can set up a company in Macedonia. Each business structure is subject to varied conditions which can be entirely explained by our advisors.

Foreign investors can open limited liability companies, joint stock companies, limited and general partnerships or sole proprietorships. The incorporation process starts with the Central Registry of the Republic of Macedonia.

Among the business types you can set up in Macedonia, the limited liability company is the most adopted one, due to its easy incorporation and lots of benefits for all investors.

A limited liability company in Macedonia or DOO (Drushtvo so Ogranichena Odgovornost), as it is known, can be registered by at least one shareholder and for a minimum share capital of EUR 5,000. The Articles of Association stand at the base of a limited liability company and represent the most important documents. Our team can assist with company formation in Macedonia.

Yes, companies from abroad can establish branches and subsidiaries in Macedonia which activate through limited liability companies. Branches depend entirely on the parent company, while the subsidiaries are independent entities. We can manage the registration process of branches and subsidiaries in Macedonia so please feel free to address your inquiries to our company incorporation representatives in Macedonia.

Joint stock companies in Macedonia can be established with a minimum share capital of EUR 50,000 if they are public. As for the private ones, these can be registered with a minimum share capital of EUR 25,000. Our team can give you more details about the share capital requirements when you decide to start the process for company formation in Macedonia.

Among the main documents of a company in Macedonia, we mention the Articles of Association and the Memorandum. We remind that our team can prepare and draft these documents to the Central Registry of the Republic of Macedonia.

Yes, special licenses and permits are necessary for your operations in Macedonia, as stipulated by the Company Act and the type of activities one can establish in this state.

The corporate tax, the income tax, the VAT, real property tax, and the transfer tax are among the important taxes you need to consider at the time of company registration in Macedonia.

You will need to schedule approximately 3 working days if you want to set up a company in Macedonia. For a better understanding of how companies can be registered in Macedonia, please feel free to contact our team of company formation representatives in Macedonia.

Companyformationmacedonia.com is a part of Bridgewest.eu, an international network that has affiliated partners throughout the world, including our partner Dutch law firm which can provide local legal assistance to foreign investors, from company registration to VAT registration in Netherlands.